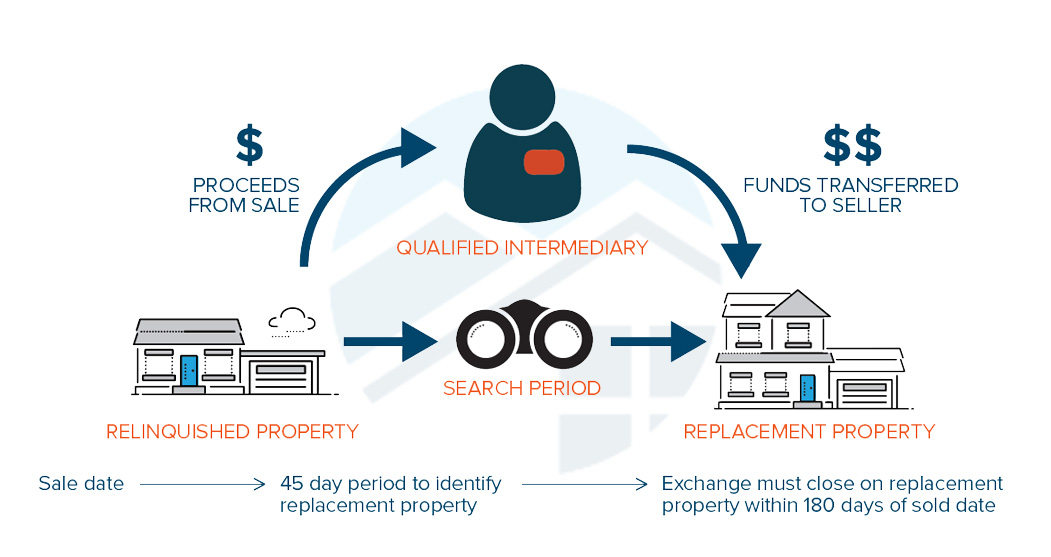

Within 45 days of the transfer of the home, a building for exchange should be identified, as well as the purchase needs to be carried out within 180 days. Like-kind homes in an exchange should be of comparable worth too. The difference in value between a residential property as well as the one being exchanged is called boot.

If individual residential property or non-like-kind home is made use of to finish the purchase, it is likewise boot, yet it does not disqualify for a 1031 exchange. The existence of a mortgage is permitted on either side of the exchange. If the home mortgage on the replacement is less than the home mortgage on the building being sold, the difference is dealt with like money boot.

Expenditures and also costs influence the value of the deal and also as a result the prospective boot also. Some expenditures can be paid with exchange funds. These include: Broker’s payment Certified intermediary charges Filing charges Relevant lawyer’s costs Title insurance coverage costs Related tax consultant fees Finder fees Escrow fees Expenditures that can not be paid with exchange funds consist of: Financing fees Home taxes Repair service or maintenance costs Insurance coverage premiums LLCs can only exchange property as an entity, unless they do a in case some partners desire to make an exchange as well as others do not.

1031 exchanges are performed by a single taxpayer as one side of the deal. Special steps are required when members of an LLC or collaboration are not in accord on the personality of a residential property. This can be fairly complicated because every property owner’s circumstance is one-of-a-kind, however the essentials are global.

Not known Factual Statements About 1031 Exchange Fund

A 1031 exchange is brought out on residential or commercial properties held for financial investment. A significant analysis of “holding for financial investment” is the length of time an asset is held. It is preferable to launch the decline (of the partner) at the very least a year before the swap of the property. Otherwise, the companion(s) joining the exchange might be seen by the internal revenue service as not meeting that criterion.

This is known as a “swap as well as decline.” Like the drop and also swap, tenancy-in-common exchanges are one more variation of 1031 deals. Occupancy in usual isn’t a joint endeavor or a collaboration (which would not be permitted to participate in a 1031 exchange), yet it is a partnership that permits you to have a fractional ownership passion directly in a huge residential property, together with one to 34 even more people/entities.

Occupancy in typical can be made use of to split or combine financial holdings, to diversify holdings, or obtain a share in a much larger possession.

Among the major benefits of participating in a 1031 exchange is that you can take that tax obligation deferment with you to the tomb. If your heirs acquire residential or commercial property gotten with a 1031 exchange, its worth is “stepped up” to fair market, which erases the tax obligation deferment financial obligation. This implies that if you pass away without having actually marketed the residential or commercial property acquired via a 1031 exchange, the heirs obtain it at the tipped up market rate worth, as well as all deferred tax obligations are eliminated.

Not known Factual Statements About 1031 Exchange Into A Fund

Occupancy alike can be used to framework properties based on your yearn for their circulation after fatality. Allow’s look at an instance of just how the owner of a financial investment property may pertain to initiate a 1031 exchange as well as the advantages of that exchange, based on the story of Mr.

The tax deferment offered by a 1031 exchange is a fantastic possibility for financiers. tax shelter real estate. Although it is complex at factors, those intricacies enable for a large amount of flexibility. This is not a procedure for a financier acting alone. Competent expert assistance is needed at practically every step. CWS Funding Partners has experience taking care of the entire 1031 exchange procedure for you and can collaborate with you to give replacement assets when you require them.

The details offered here is for your general informational functions only. It should not be thought about a recommendation or tailored advisory guidance. CWS has actually made this 3rd party info available from writers it thinks are knowledgeable as well as reliable sources. Its accuracy or efficiency can not be assured and belief may alter due to lawful or economic problems.

The smart Trick of Real Estate Investment Companies In California That Nobody is Talking About

You should familiarize yourself with all risks associated with any kind of financial investment item before spending. Advisory solutions are supplied by CWS Resources Partners LLC, a licensed financial investment consultant.

A 1031 exchange is a kind of property acquisition allowed under Section 1031 of the US Internal Revenue Code. It enables you to defer funding gains taxes when marketing a home, as long as the proceeds are used towards a comparable investment within a specific time structure – what is 1031 exchange california. As Adam Kaufman, founder and also principal running policeman of realty crowdfunding system Arbor, Crowd, discusses: “By utilizing 1031 exchanges, actual estate investors have the ability to sell a property possession as well as reinvest the earnings right into a like-kind financial investment – an additional realty possession – and also defer the resources gains tax obligation related to the deal.”Exactly how a 1031 exchange jobs, The specific 1031 exchange process depends on the kind you’re using (more on this later).

https://www.youtube.com/embed/dvUs877QjeI

Then, like several financiers, you’ll possibly wish to have a qualified intermediary hold the earnings of your sale till you have actually recognized the property or homes you would love to purchase. After that, you have 45 days to discover your substitute investment as well as 180 days to buy it. You can expect a qualified intermediary to set you back around $600 to $1,200, depending on the transaction.

It appears difficult, yet there are lots of factors you might use a 1031 exchange.”You can likewise make use of a 1031 exchange to purchase a residential or commercial property with much better cash circulation or reset the clock on depreciation.

The 3-Minute Rule for What Is 1031 Exchange California

For household rental residential or commercial properties, the benefit is gradually expanded over 27 years (1031 exchange california). Usually, if you utilized depreciation to your benefit, then you would certainly owe what’s known as depreciation regain – or earnings taxes on the monetary gains you realized from doing so – when you sell the house. Making use of a 1031 exchange can enable you to push these repayments bent on a later date.

You’ll still owe a selection of closing costs and also various other fees for buying and marketing a home. Most of these may be covered by exchange funds, yet there’s argument around exactly which ones. california 1031 exchange. To discover which costs as well as costs you may owe for a 1031 exchange transaction, it’s finest to speak with a tax obligation professional.